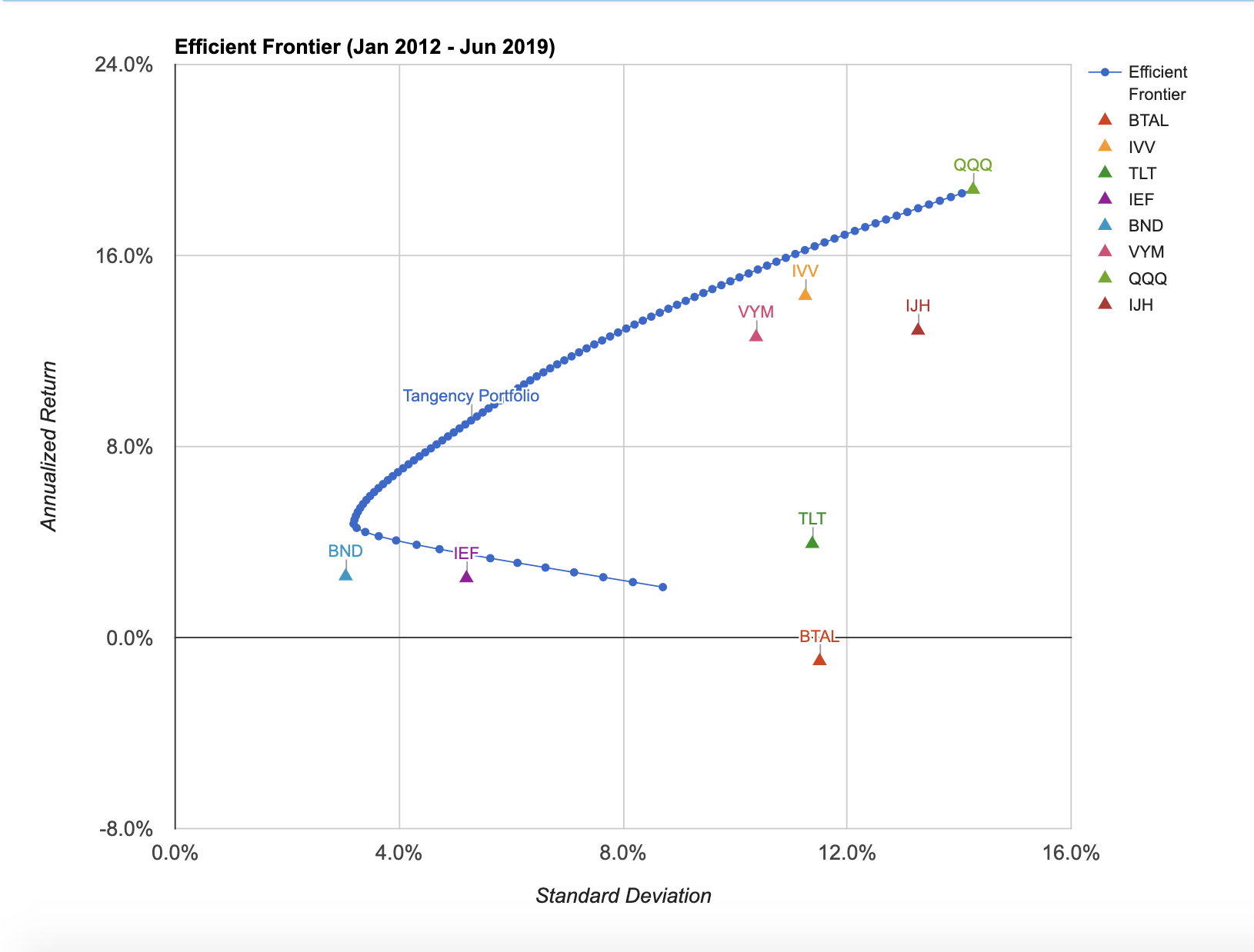

Long/short portfolio optimization for the market crash of late 2018, Sharpe ratio 1.82, Return 35.4%

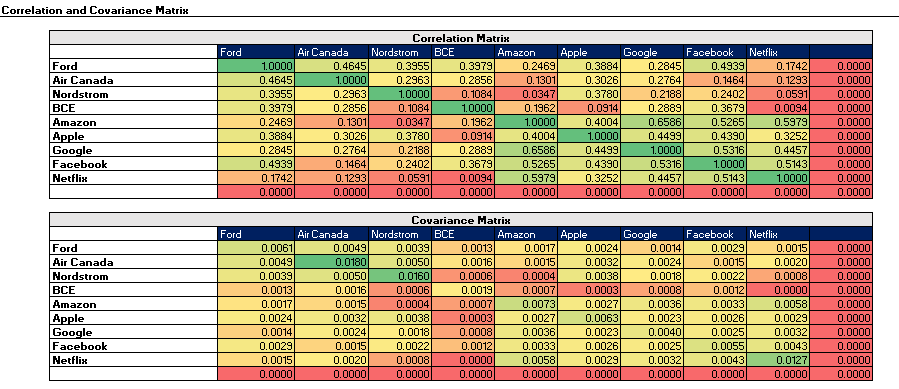

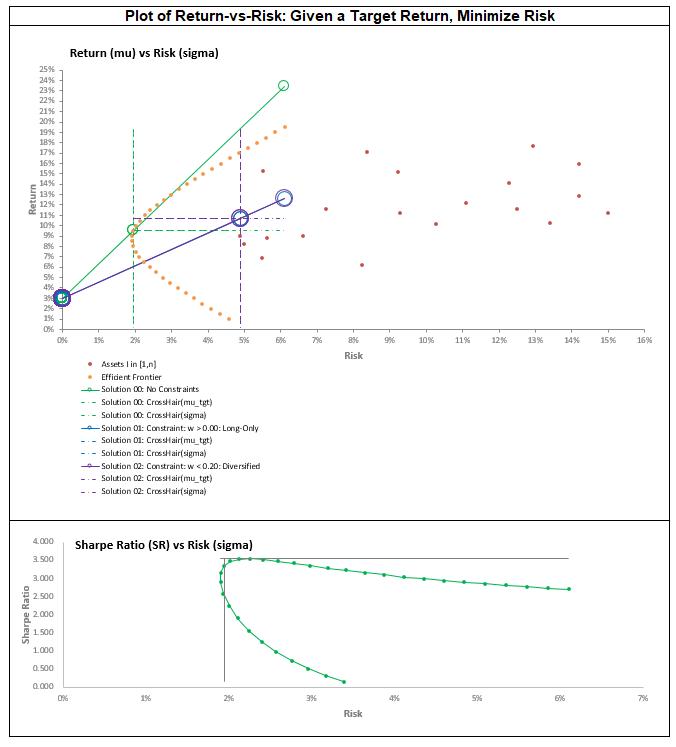

Quant Bible | Portfolio Optimization for 20 Securities Using Lagrange Multipliers, No Short-Selling, Weights Sum to 1

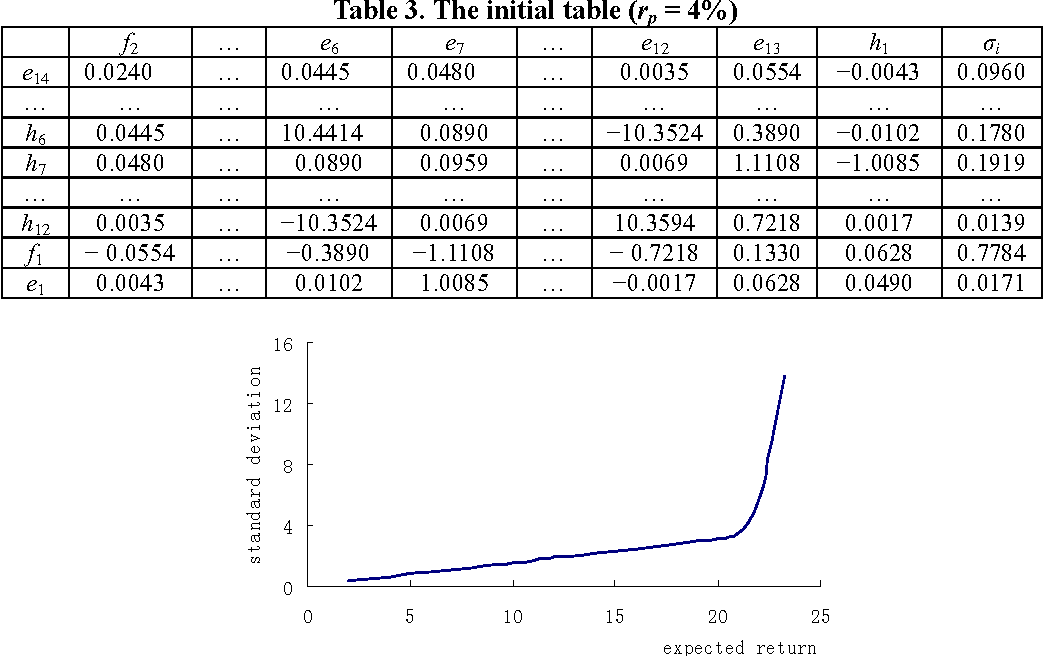

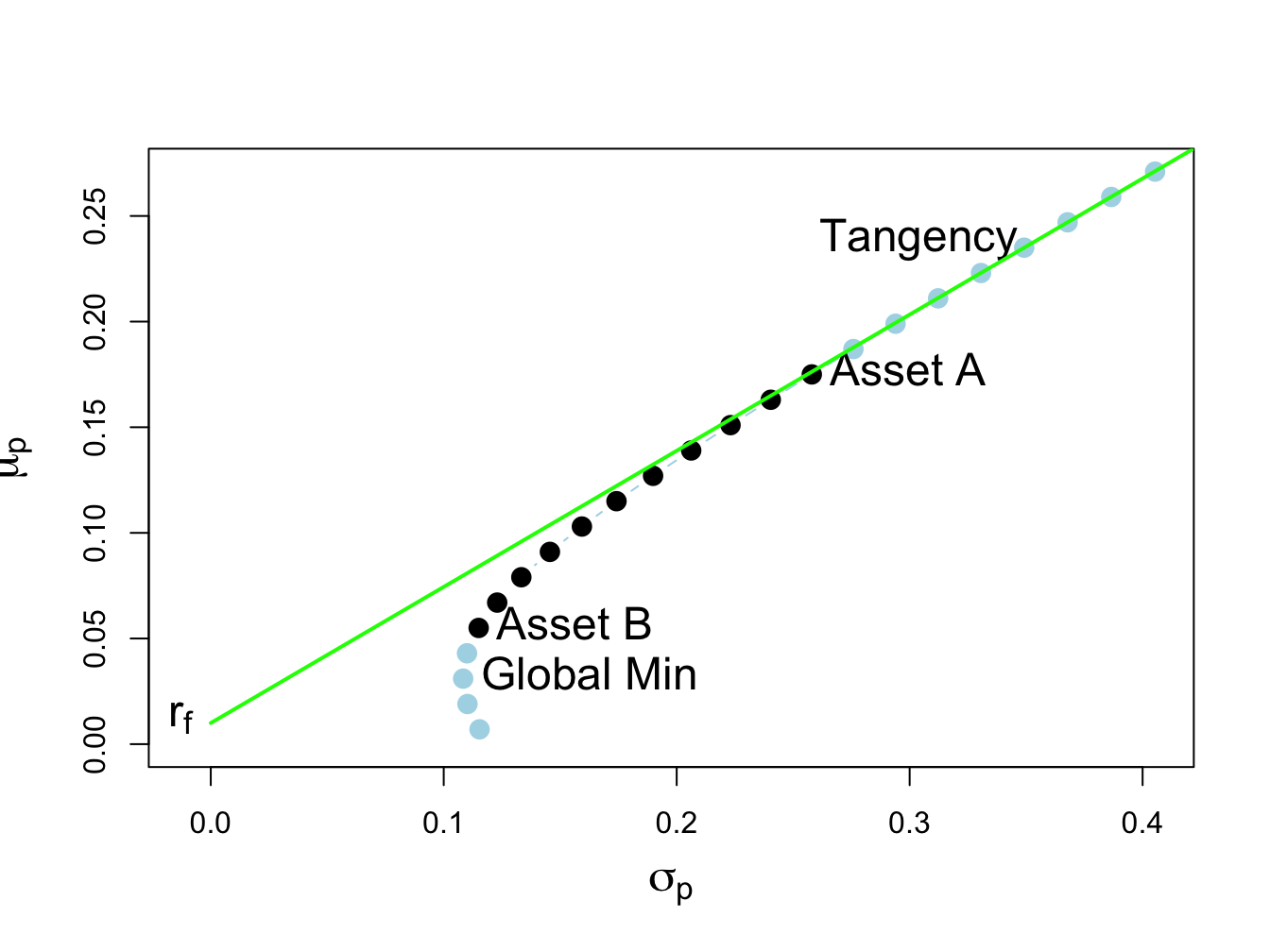

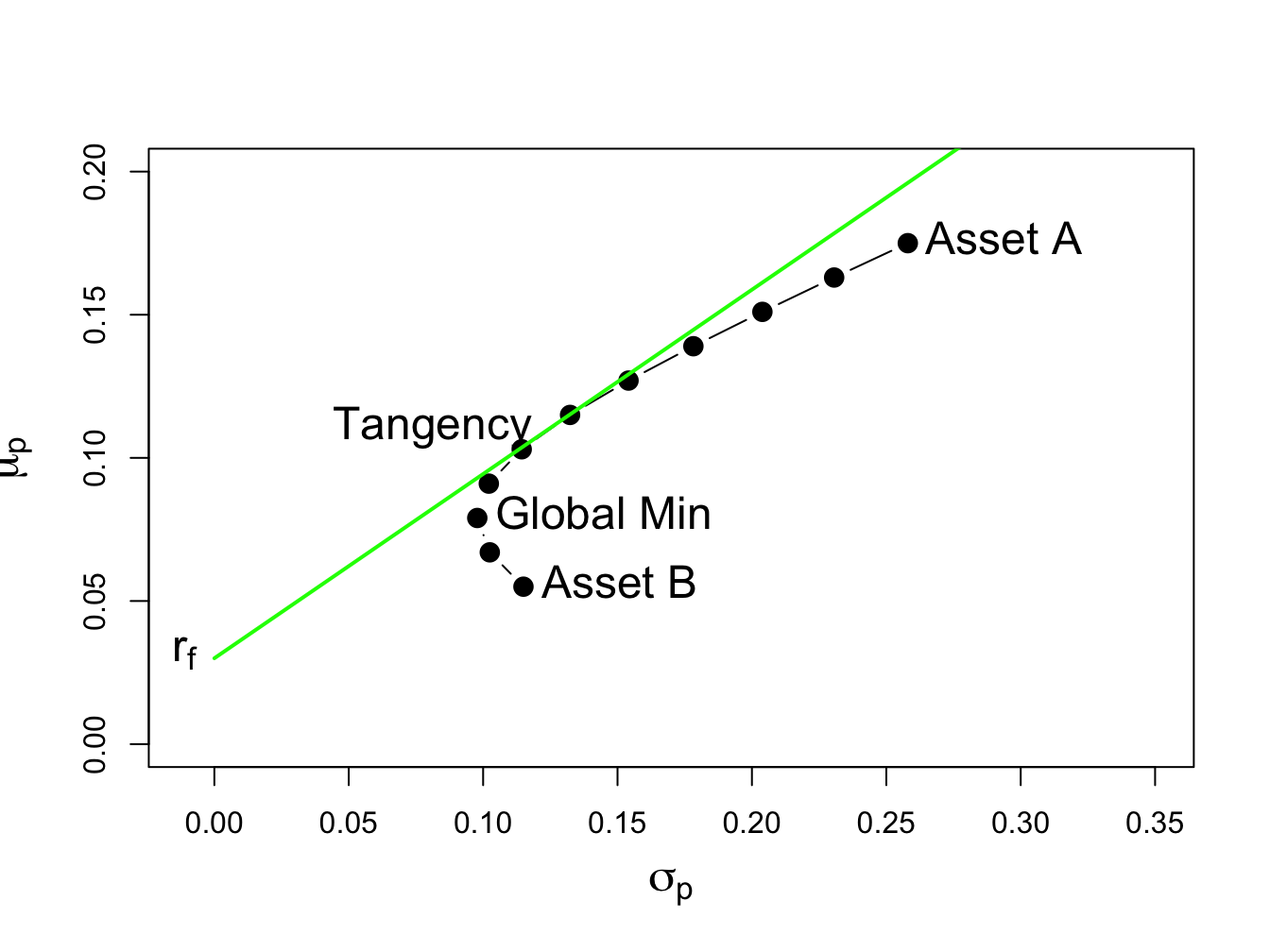

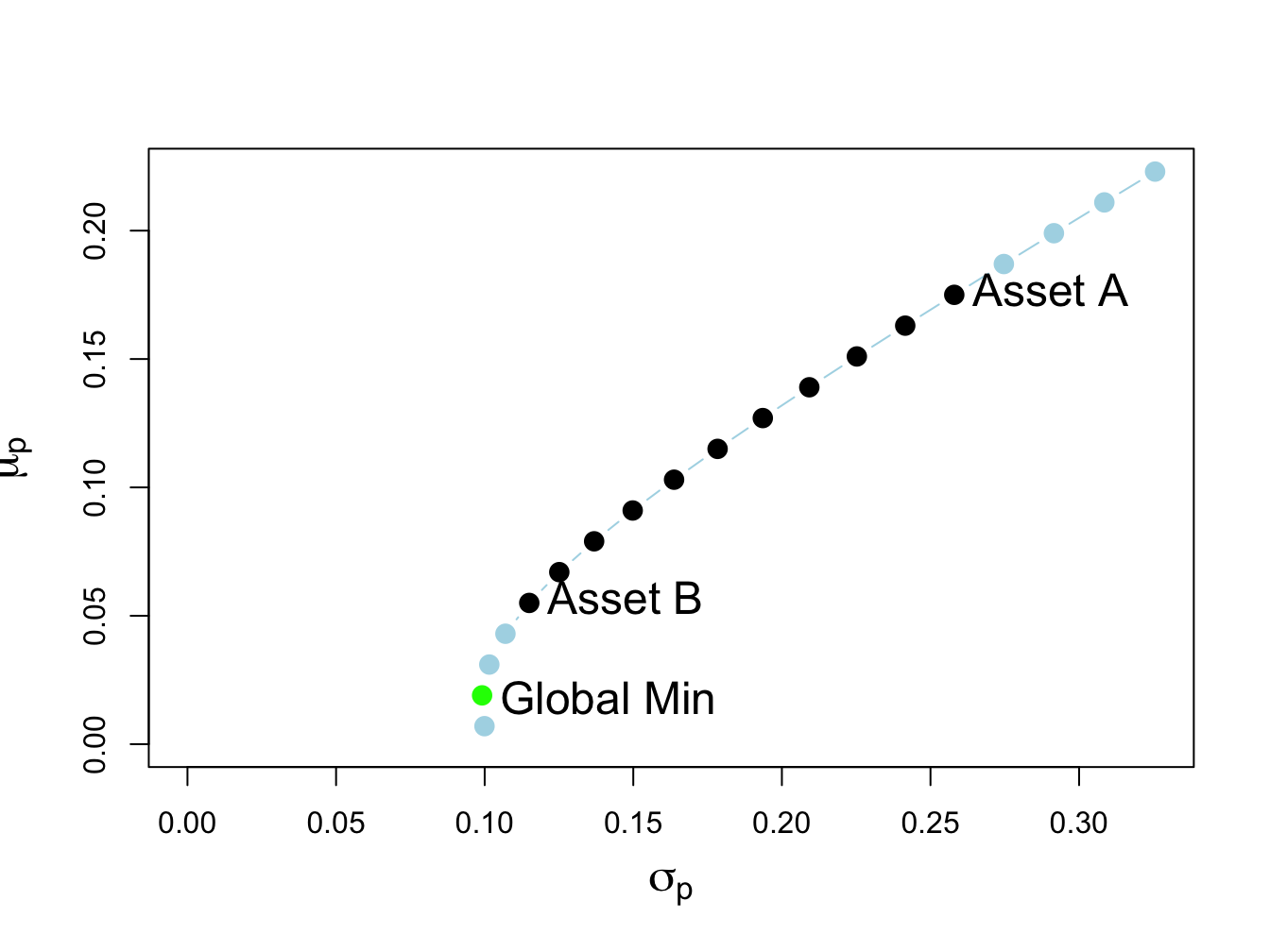

13 Portfolio Theory with Short Sales Constraints | Introduction to Computational Finance and Financial Econometrics with R

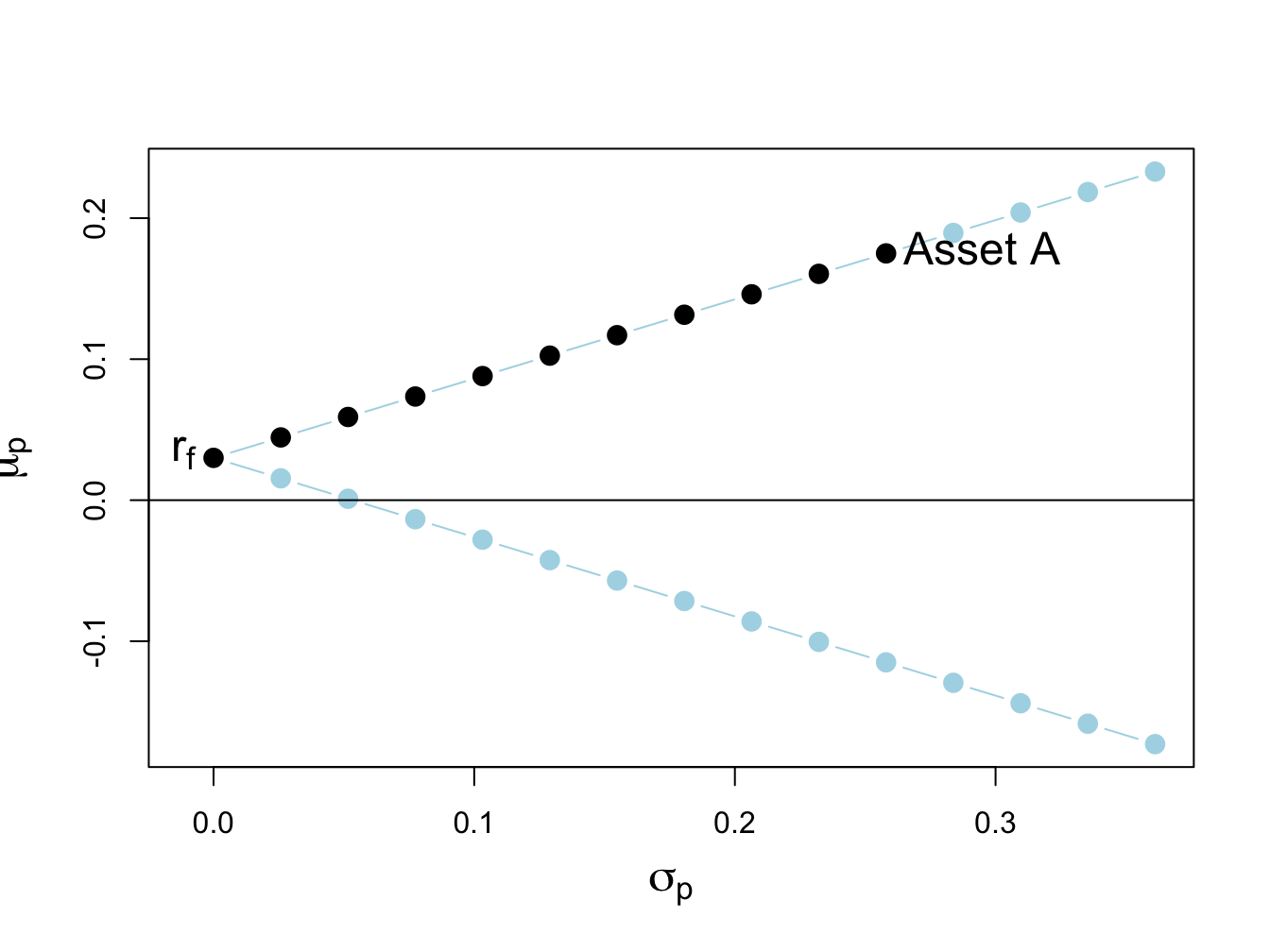

The Smart Money Prefers Long/Short Portfolios, But The Vast Majority Of AUM Is Long-Only | Seeking Alpha

13 Portfolio Theory with Short Sales Constraints | Introduction to Computational Finance and Financial Econometrics with R

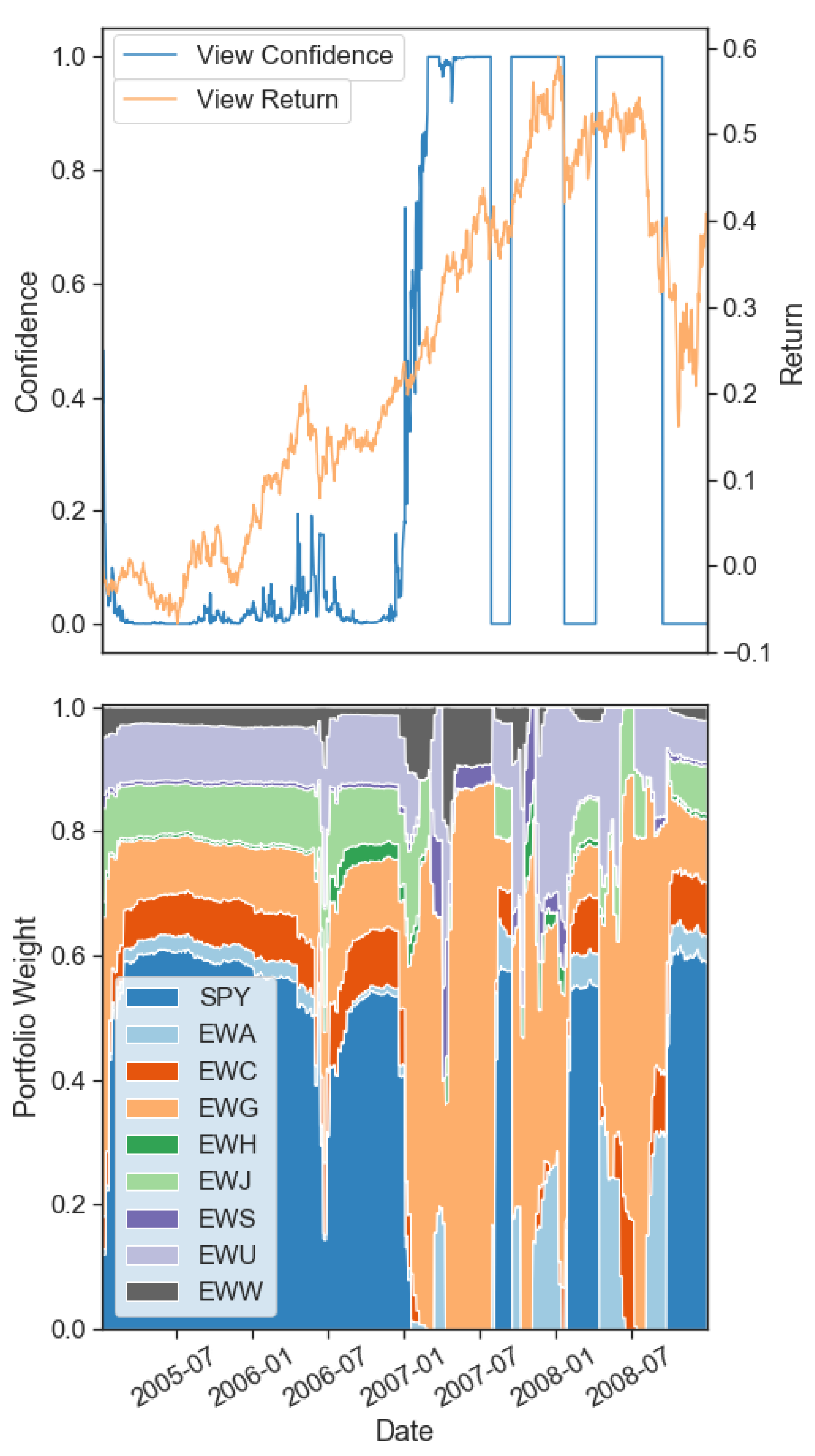

JRFM | Free Full-Text | Multi-Period Portfolio Optimization with Investor Views under Regime Switching

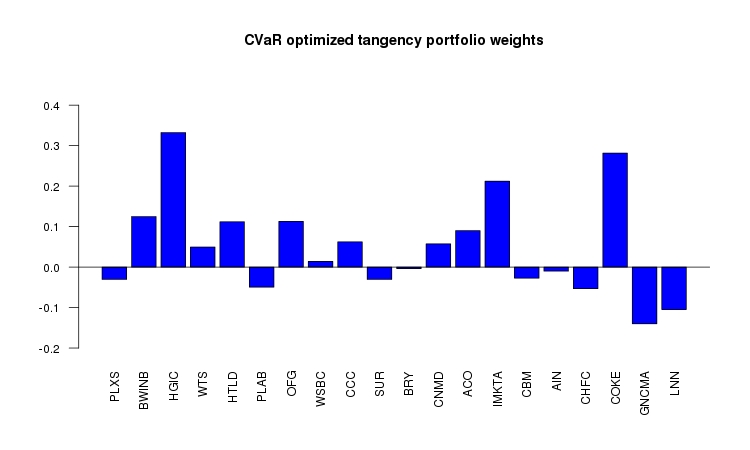

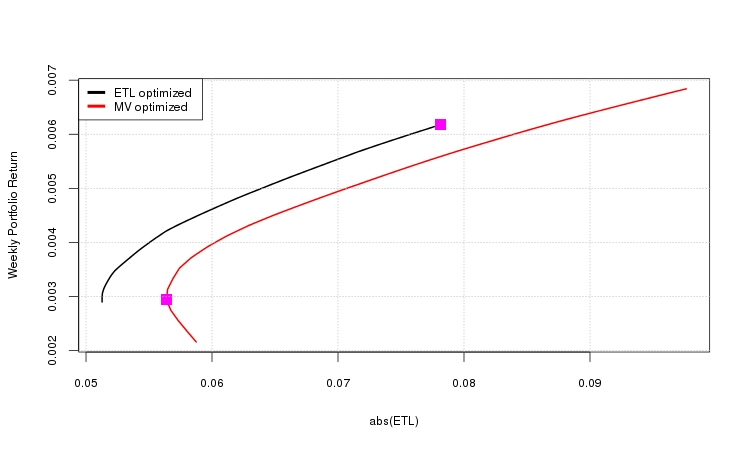

Long Short Portfolio Optimisation under Mean-Variance-CVaR Framework Gautam Mitra CARISMA, Brunel University and OptiRisk systems, UK Diana Roman CARISMA, - ppt download

Long/short portfolio optimization for the market crash of late 2018, Sharpe ratio 1.82, Return 35.4%

13 Portfolio Theory with Short Sales Constraints | Introduction to Computational Finance and Financial Econometrics with R

![PDF] Portfolio Optimization-Based Stock Prediction Using Long-Short Term Memory Network in Quantitative Trading | Semantic Scholar PDF] Portfolio Optimization-Based Stock Prediction Using Long-Short Term Memory Network in Quantitative Trading | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/54ae9d8e95ae8be88e4bff9c891a1a1e3978553e/6-Figure2-1.png)

PDF] Portfolio Optimization-Based Stock Prediction Using Long-Short Term Memory Network in Quantitative Trading | Semantic Scholar

Long/short portfolio optimization for the market crash of late 2018, Sharpe ratio 1.82, Return 35.4%

Figure A1. This figure illustrates a graphical flowchart that shows a... | Download Scientific Diagram

13 Portfolio Theory with Short Sales Constraints | Introduction to Computational Finance and Financial Econometrics with R

Fundamental Factor Long/Short Strategy with Mean Variance Portfolio Optimization by Jing Wu - QuantConnect.com